(Bloomberg) — Qualcomm Inc. , the most important maker of smartphone processors, fell 8.2% in late buying and selling after it delivered a tepid gross sales forecast for the present quarter, indicating that demand for cellular units stays weak.

Most Learn from Bloomberg

Qualcomm stated Wednesday in an announcement that gross sales will vary between $8.1 billion and $8.9 billion within the fourth quarter of the fiscal yr. The midpoint of this vary is properly beneath the common analyst estimate of $8.79 billion.

The forecast renewed considerations concerning the smartphone trade within the grip of its worst downturn in years. Qualcomm and its chip friends have seen orders drop sharply from cell phone producers, which out of the blue had extra stock than they wanted. Qualcomm executives stated on a convention name that spending cuts on parts for telephones and different digital units will proceed by way of the tip of the yr.

Qualcomm stated the corporate is taking steps to cut back its bills, even because it invests in new merchandise that can profit from the unfold of synthetic intelligence in smartphones. The variety of staff has already been lowered. Final quarter, Qualcomm posted $285 million in restructuring charges, largely from severance funds, and it expects to make extra workforce cuts.

“We take a conservative view of the market, and can proactively take further price measures to make sure that Qualcomm is properly positioned to ship most worth to shareholders in an unsure setting,” CEO Cristiano Amon stated on the decision.

Shares fell to a low of $118.71 in prolonged commerce after the earnings announcement. Previous to the report, Qualcomm inventory had elevated about 18% this yr. That led to a decline within the efficiency of the chip trade extra broadly, with the Philadelphia Inventory Alternate semiconductor index up about 47% in 2023.

Excluding some objects, Qualcomm stated, the revenue will likely be $1.80 to $2 per share within the present interval. That compares with a forecast of $1.94.

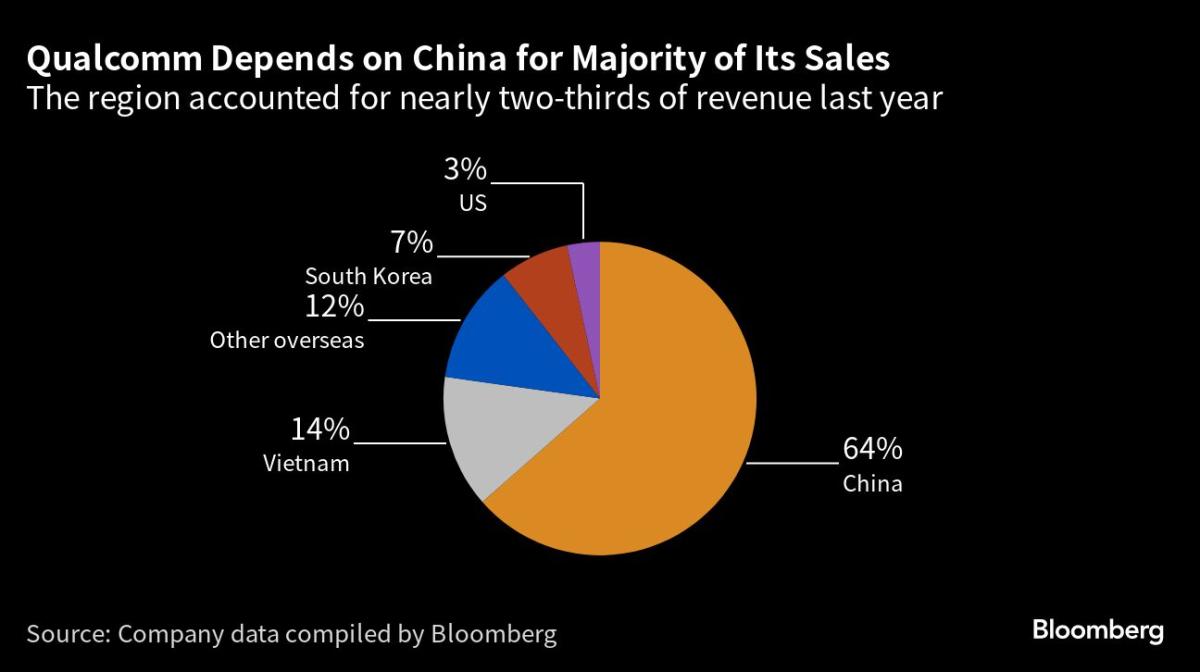

A significant drawback: Demand in China, the most important cellphone market, has not returned to anticipated ranges. That area gives the corporate with greater than 60% of its gross sales.

General, cellular shipments will decline by at the very least a excessive single-digit proportion this yr in comparison with 2022, Qualcomm stated in its earnings presentation, indicating that the outlook has been dampened barely.

“Because the timing of a sustainable restoration stays troublesome to foretell and clients stay cautious of their purchases, we proceed to function underneath the idea that stock drawdown dynamics will likely be an element by way of the tip of the calendar yr,” the chip maker stated within the presentation. .

Amon is working to make his firm much less depending on the unreliable smartphone market. The San Diego-based firm has elevated gross sales of chips for automotive, networking, computing and wearable units, however nonetheless will get greater than half of its income from the cell phone trade.

The corporate’s flagship product is a processor that powers most of the world’s hottest telephones. It additionally sells the modem chips that join the iPhone to high-speed information networks. An extra portion of Qualcomm’s income comes from licensing the underlying know-how that underpins all trendy cellular networks — the charge cellphone producers pay whether or not or not they use Qualcomm-branded chips.

Amon confirmed that Qualcomm’s modem will likely be within the new model of the iPhone due later this yr, however declined to touch upon whether or not it’s going to proceed to supply this important element in future fashions. Bloomberg reviews that Apple is creating its personal modem.

Within the third fiscal quarter, which ended June 25, earnings fell to $1.87 per share. Income fell 23 p.c to $8.45 billion. Analysts had estimated a revenue of $1.81 on gross sales of $8.51 billion.

Cellphone-related gross sales had been $5.26 billion, in comparison with a mean estimate of $5.48 billion. Automotive income rose from the prior yr to $434 million, down from the estimate of $448 million. Gross sales from related units had been in step with estimates at $1.5 billion.

Most Learn from Bloomberg Businessweek

© 2023 Bloomberg LP